Watch the video to learn more about RPG’s approach to finance.

Let’s face it. We know you’re hearing so many claims from builders right now … So, we want to be clear about the RPG unique difference right from the start. Here’s why our Regional NSW customers choose us:

Our process guarantees a fixed price within ten days, avoiding the financial uncertainty and delays typical with other builders. Plus, our turn-key approach lets you secure finance early, preventing additional costs.

We align with lending requirements for easy finance approval and no surprises in costs or contract changes. Unlike other builders who risk delays and financial uncertainty, we keep everything straightforward.

RPG’s turn-key duplexes are designed for investors. We use efficient replication and prefabricated materials, speeding up the build and tenant move-in. All essentials, from landscaping to letterboxes, are included in a complete package.

Unlike other companies, we've been based in regional NSW since day one. We know the best locations for growth and rental yields, and we have long-term solid connections and local oversight—no remote interstate offices here.

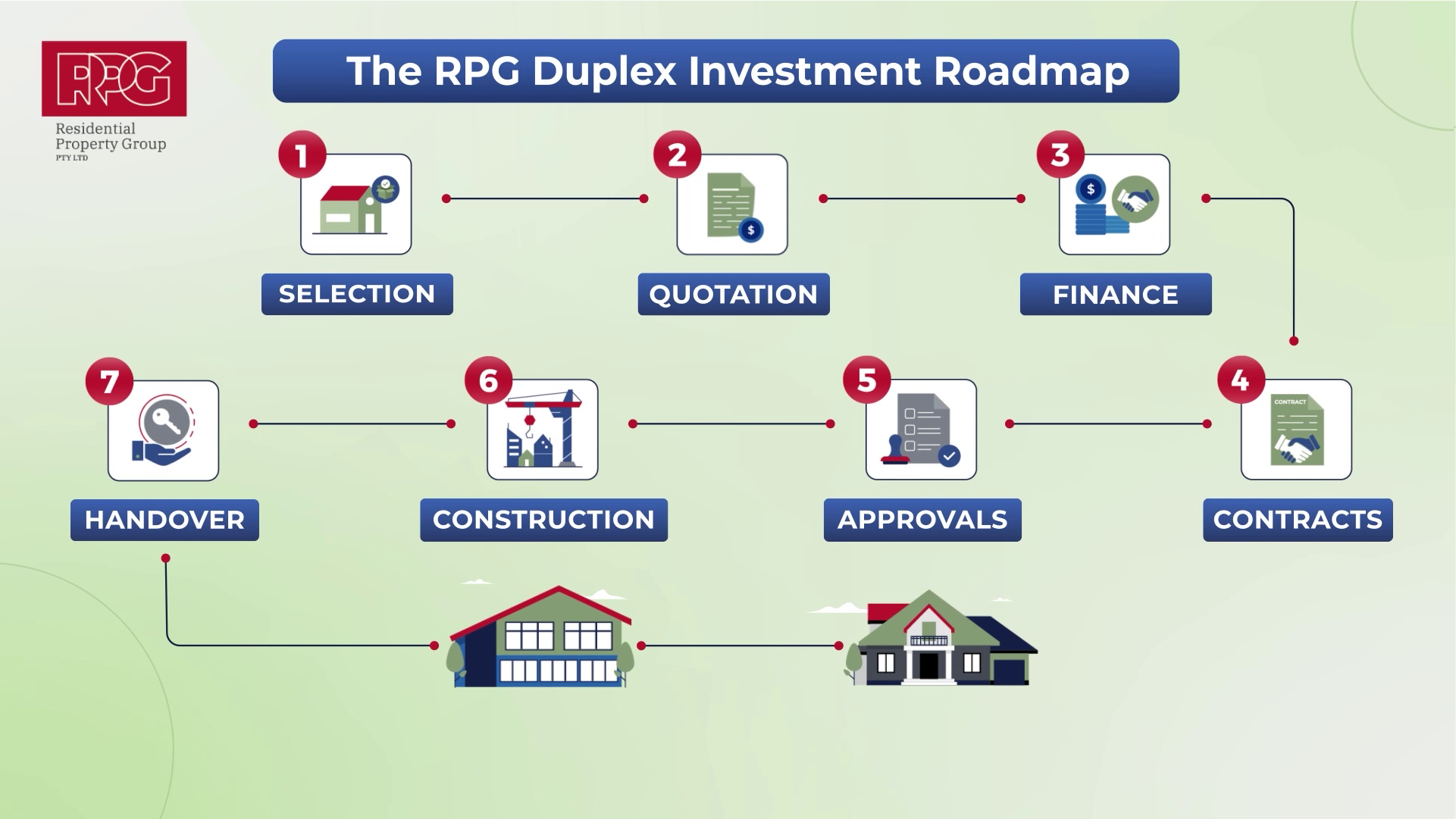

Here’s a step-by-step guide on how we bring it all to life:

Yes. New duplexes can generate over $20,000 per year in depreciation deductions — far more than older properties.

That improves your cash flow and reduces your taxable income, especially in the early years of ownership.

A quote is an early estimate. It’s usually based on limited information — often before a site inspection or proper planning assessment has been done.

That means it’s subject to change. In most cases, it’s just a rough ballpark to keep the conversation going.

A fixed price, on the other hand, is contract-ready. It reflects all known costs — including siteworks, approvals, materials, and finishes. It’s the figure you can take to your lender and build with confidence.

Every step is designed from day one to protect your investment, deliver consistent cash flow, and set you up for long-term financial success.

Because without it, you’re not in a position to move forward — no matter how ready you think you are.

Pre-approval isn’t just a formality. It tells you exactly what you can borrow, so you’re not wasting time on packages that won’t work. It also puts you in a stronger negotiating position when the right opportunity comes up — because you can act immediately.

And most importantly, it means your builder can give you real advice. Without it, all they can offer is ballpark figures and generic options — and that’s how delays and budget issues start.

If you don’t know your borrowing capacity, you’re not ready to build. It’s that simple.

Ask about approvals: are they using a Complying Development Certificate (CDC) or a full Development Application (DA)?

CDC is typically faster and less risky.

DA can take 6–12 months — and open the door for contract repricing.

Ask about their pricing: is it a fixed price, or does it include Prime Costs (PCs) and Provisional Sums (PS) that allow the builder to add extra charges later?

And ask about their financial standing: what’s their rating under the Home Building Compensation Fund (HBCF)?

A builder with poor HBCF capacity could leave you stranded mid-project if they collapse — and that’s not uncommon in today’s market.

Look out for Prime Cost items (like cheap allowances for appliances) and Provisional Sums (for unknown siteworks or materials).

These costs often show up later — along with a builder’s margin. RPG contracts are genuinely fixed — no allowances, no surprises.

We provide a full defect period, structural warranty and referrals to trusted local property managers in your build area.

We don’t disappear at handover — we make sure your investment is set up to perform long-term.